Welcome to Power Line, a weekly energy newsletter brought to you by Business Insider.

Here’s what you need to know:

- There will be no newsletter next week.

- Want to get Power Line in your inbox every Friday? Sign up here.

- Most of our content is available to BI Prime subscribers. Click here for 20% off.

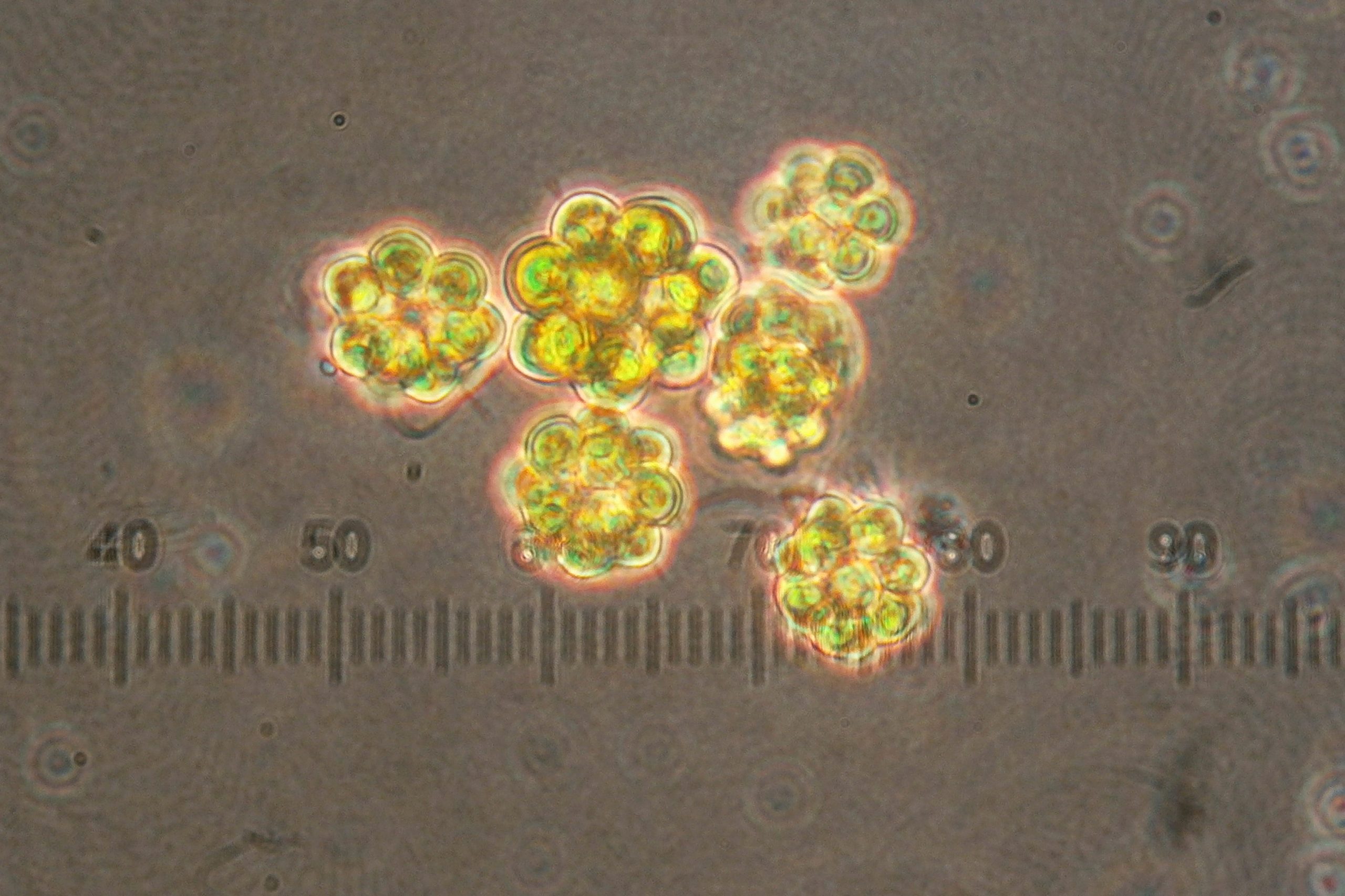

Now would be a good time to explain that I’m obsessed with algae, AKA pond scum. We all should be.

These organisms are the reason that Earth became a breathable planet. They’re also responsible for all the crude oil in the ground. Indeed, petroleum deposits in the Earth’s crust are little more than the ancient remains of algae.

A group of mostly photosynthetic microbes, algae boast an impressive concentration of lipids, or fats, in their cells. And as researchers learned decades ago, you don't have to wait eons to turn them into oil …

Why Exxon is still betting algae biofuels are the future a decade after other oil giants abandoned their multimillion-dollar projects

Owing to their high concentrations of lipids and rapid growth, algae are near-perfect candidates for biofuel production. You can grow them in ponds and then process them into fuels like diesel.

But: Those fuels are really expensive to produce relative to crude oil extracted from the ground. Several companies learned this the hard way including oil majors Shell and BP.

- More than a decade ago, Shell and BP, among scores of other companies, invested millions in algae biofuel research.

- A few years later, they abandoned those projects. Former employees said it came down to poor economics.

Exxon remains the only major oil company still betting big on algae biofuels, leading top algae scientists to question the company's intentions.

Read more in our feature on Exxon's algae biofuel bet

These 21 emerging leaders in the clean-energy industry will give you hope for the future

This week we published our list of rising stars in clean energy. It's a reminder that while it may feels like the world is falling apart, there are a lot of incredible people building it back up.

- Gia Schneider is a former Credit Suisse banker who is now building a new generation of river-friendly water turbines with the backing of a Bill Gates-led fund.

- After witnessing the effects of pollution near her Texas hometown, Etosha Cave has figured out how to turn carbon emissions into stuff we actually want.

- Gene Berdichevsky was employee number 7 at Tesla. Now he's leading his own company that's building batteries that promise to give electric cars 20% more range.

Though ultimately motivated by the threat of climate change, these emerging leaders are taking a bite out of a $600 billion industry for clean energy.

- Clean energy will be a $16 trillion investment opportunity through 2030, according to Goldman Sachs.

See the full list of 21 rising stars here

Shell and BP are writing down up to $40 billion in assets. Here's what that means.

BP announced in mid-June that it's writing down oil and gas assets by as much as $17.5 billion. Now, Shell is following suit, with an announcement this week that it would write down its assets by up to $22 billion.

Write-downs, explained: When companies write down their assets it means they're acknowledging that those assets are worth less than the value they originally ascribed to them.

Why it matters: The write-downs are another example of the pandemic's toll on the oil and gas industry. They're also a sign that these companies are preparing for a lower-carbon economy.

- The pandemic has gutted demand for oil, sending the price-per-barrel tumbling. Cheap oil and an outlook of lower demand makes oil-related assets less valuable.

- These write-downs suggest that some oil and gas resources may be left in the ground.

- BP said it expects the transition to low-carbon energy to accelerate in the wake of the pandemic when it announced the write-downs.

- Shell made a similar statement: "The Refining asset valuation updates reflect Shell's strategy to reshape and focus its refining portfolio to support the decarbonization of its energy product mix."

Investing: Goldman Sachs shares its top 9 oil stocks

Oil price today: Brent crude started trading at $42 a barrel on Thursday, up about 6% since early June and down about 36% since the start of the year.

Price in 2021: $55 a barrel, on average, Goldman Sachs said in a note Wednesday. That's roughly $10 below where it was before the pandemic took hold.

In the note, Goldman analysts also shared their top stock picks for integrated oil companies and refiners, which turn crude into fuel and other products. You can see all of their picks here.

4 big stories from this week

- Chesapeake Energy, a natural gas pioneer, filed for bankruptcy. (New York Times)

- BP agreed to sell its petrochemical business to the British chemicals company Ineos for $5 billion. (WSJ)

- House Dems released a sweeping climate-change plan that "laid out policies to help the US work toward net-zero greenhouse gas emissions in all areas of the nation's economy by midcentury," Greentech Media reports.

- Tesla overtook Exxon in market value "in a sign that investors are increasingly betting on a global energy transition away from fossil fuels," Bloomberg News reports.

That's it! Have a safe 4th of July weekend.

- Benji